- In a salon, how do you calculate the break-even point?

- How do you perform a service break-even analysis?

- How can you figure out what the breakeven price is?

- What are the three approaches for determining break-even point?

- What is an example of a breakeven point?

- What is the unit formula for the break-even point?

- What’s the best way to make a breakeven chart?

- What elements make up a break-even analysis?

- To break even, how many units must be sold?

- How do you figure out the break-even quantity in this case?

- What is a PPT on break-even analysis?

- A break-even analysis is a type of method

- What are your thoughts on break-even analysis?

- How many different methods are used to determine the break-even point?

- What does a company do when it reaches breakeven?

- How do you do a breakeven analysis in Excel?

- How do you create a breakeven chart in Excel?

- How do you do a breakeven analysis for multiple products?

- What information does a business always need to have when it conducts a break-even analysis?

- Is tax included in break-even?

- Do you include depreciation in break-even analysis?

- What does the breakeven quantity tell you?

- What are the limitations in using break-even analysis?

- How is breakeven analysis useful in business decisions?

- How long should a business take to break-even?

- How do I make a breakeven chart in Google Sheets?

- What is contribution formula?

- How do you calculate the breakeven point in a trading company?

- How do changes in the mix of products impact breakeven?

- How can a company that produces multiple products use CVP analysis?

- When you reach break-even, do you have to pay capital gains?

In a salon, how do you calculate the break-even point?

Fixed costs (sales price per unit – variable cost per unit) = break-even point in units.

How do you perform a service break-even analysis?

How to figure out what your break-even point is.

- When calculating a break-even point based on sales dollars, keep the following in mind: Subtract the contribution margin from the fixed costs.

- Fixed Costs + Contribution Margin = Break-Even Point (sales dollars).

- Product Price – Variable Costs = Contribution Margin.

How can you figure out what the breakeven price is?

The formula for calculating the break-even price is (Total fixed cost/Production unit volume) + Variable Cost per unit.

What are the three approaches for determining break-even point?

This section gives an overview of the several approaches for calculating the break-even point.

- Equation/Algebraic Method.

- Method of Contribution Margin (or Unit Cost Basis).

- Total Basis of the Budget.

- Method of Graphical Presentation (Break-Even Chart or CVP Graph).

What is an example of a breakeven point?

Assume a corporation with $1 million in fixed costs and a 37 percent gross margin. It costs $2.7 Million to break even ($1 million / 0.37). To pay its fixed and variable costs, the corporation must generate $2.7 Million in revenue in this breakeven point example. The corporation will make money if it creates more sales.

What is the unit formula for the break-even point?

Fixed Costs (Revenue per Unit – Variable Cost per Unit) = Break-Even Point (Units). Fixed costs are costs that remain constant regardless of the number of units sold. The price at which products are sold minus variable costs such as materials, labor, and so on, is referred to as revenue.

What’s the best way to make a breakeven chart?

Break-even analysis.

- The break-even point can be determined by plotting how fixed costs, variable costs, total costs, and total revenue change as output increases.

- Create a chart with the horizontal (x) axis representing output (units) and the vertical (y) axis representing costs and revenue.

What elements make up a break-even analysis?

Fixed cost/Price per cost – Variable cost = Break-even point As a result, based on the pen’s variable costs, fixed costs, and selling price, company X would need to sell 10,000 units to break even.

To break even, how many units must be sold?

The Equation of the Break-Even Point To cover your expenses, you must sell six units per day. Every unit sold in excess of six per day generates a profit for your company.

How do you figure out the break-even quantity in this case?

Use the following formula to calculate the break-even point in units: Break-Even point (units) = Fixed Costs (Sales price per unit – Variable costs per unit) or in dollars using the formula: Fixed Costs Contribution Margin = Break-Even Point (sales dollars).

What is a PPT on break-even analysis?

The break-even point (BEP) is the point in economics and business, specifically cost accounting, where cost or expenses and revenue are equal: There is no net loss or gain, and one has “broken even”.

A break-even analysis is a type of method

ADVERTISEMENTS: Break-even analysis is a method used by most businesses to determine the relationship between costs, revenue, and profits at various output levels. It aids in determining the point at which revenue equals costs in the production process.

What are your thoughts on break-even analysis?

Your break-even point is equal to your fixed costs minus variable costs divided by your average price. Basically, you’ll need to calculate your net profit per unit sold and divide it by your fixed costs. This will tell you how many units you need to sell in order to break even.

How many different methods are used to determine the break-even point?

We can determine our break even point using one of two methods: The method of equations. The method based on formulas.

What does a company do when it reaches breakeven?

Your total sales equal your total expenses when your business reaches break-even point. This means you’re bringing in the same amount of money as you need to cover all of your expenses and run your company. When you break-even, your business does not profit. But, it also does not have a loss.

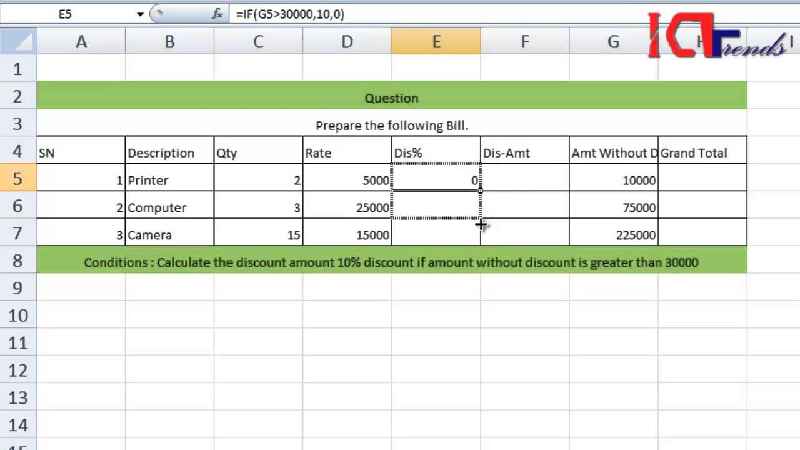

How do you do a breakeven analysis in Excel?

Calculate Break-Even analysis in Excel with formula.

- Type the formula = B6/B2+B4 into Cell B1 to calculating the Unit Price,.

- Type the formula = B1B2 into Cell B3 to calculate the revenue,.

- Type the formula = B2B4 into Cell B5 to calculate variable costs.

How do you create a breakeven chart in Excel?

A part of the suggested span transcript before expanded is And this break-even analysis is showing that the yellow line of revenue. And the grey line of total. You can view more by clicking More button at the end of this text.

How do you do a breakeven analysis for multiple products?

Break-even analysis for multiple products is made possible by calculating weighted average contribution margins. The break-even point in units is equal to total fixed costs divided by the weighted average contribution margin per unit (WACMU) (WACMU).

What information does a business always need to have when it conducts a break-even analysis?

Your break-even point is equal to your fixed costs minus variable costs divided by your average price. Basically, you’ll need to calculate your net profit per unit sold and divide it by your fixed costs. This will tell you how many units you need to sell in order to break even.

Is tax included in break-even?

Operating income at the breakeven point is zero, and no income taxes are paid at this point. The break-even point represents the level of sales revenue that equals the total of the variable and fixed costs for a given volume of output at a particular capacity use rate.

Do you include depreciation in break-even analysis?

Formula for Break-Even Analysis Total Fixed Costs are usually known; they include things like rent, salaries, utilities, interest expense, depreciation, and amortization. Total Variable Costs are tougher to know, but they are estimable and include things like direct material, billable labor, commissions, and fees.

What does the breakeven quantity tell you?

Breakeven quantity is the number of incremental units that the firm needs to sell to cover the cost of a marketing program or other type of investment, says Avery. If the company doesn’t sell the equivalent of the BEQ as a result of the investment, then it’s losing money and it wont recoup its costs.

What are the limitations in using break-even analysis?

However, break-even analysis does have some drawbacks: Break-even assumes a business will sell all of the stock (of a particular product) at the same price. Businesses can be unrealistic in their calculations. Variable costs could change regularly, meaning the analysis could be inaccurate.

How is breakeven analysis useful in business decisions?

Break-even analysis helps you determine the amount of sales needed to break even. Break-even is used to answer questions such as: What is the minimum level of sales needed to ensure there is not a financial loss and how sensitive is break-even sales volume to changes in costs or price?

How long should a business take to break-even?

It takes two to three years for a business to be profitable on average. When a company starts to make profit depends on how high its startup costs are.

How do I make a breakeven chart in Google Sheets?

A part of the suggested span transcript before expanded is The way I approach it is first what are we trying to determine were trying to determine break even. You can view more by clicking More button at the end of this text.

What is contribution formula?

Formulae: Contribution = total sales less total variable costs. Contribution per unit = selling price per unit less variable costs per unit. Total contribution can also be calculated as: Contribution per unit x number of units sold.

How do you calculate the breakeven point in a trading company?

In trading, the break-even percentage is the number of trades you need to win to break even. To calculate your break-even percentage, divide your stop-loss by your target plus stop loss, and multiply by 100 .

How do changes in the mix of products impact breakeven?

Consequently, the break-even point in a multi-product environment depends on the mix of products sold. Further, when the mix of products changes, so does the break-even point. If demand shifts and customers purchase more low-margin products, then the break-even point rises.

How can a company that produces multiple products use CVP analysis?

The easiest way to use cost-volume-profit analysis for a multi-product company is to use dollars of sales as the volume measure. For CVP purposes, a multi-product company must assume a given product mix or sales mix.

When you reach break-even, do you have to pay capital gains?

Right present, the answer in the United States is no. Only the gains are subject to taxation. So if you broke even, it means that whatever profits you achieved on one stock were offset by losses you experienced on another. Both of them balance each other out.

Category:Spas & Beauty Services